Carrie Sheffield: Inflationary $3.5T plan would hurt poor, elderly, minorities

Politicians often talk about reducing inequality and helping the most vulnerable. Today, worsening economic conditions threaten to take us in the opposite direction. Poor, minority, and elderly families are hardest hit by rising inflation—a whopping 5.4% price increase in July compared to a year ago, a spike not reported by the Bureau of Labor Statistics since the Great Recession started in summer 2008. Democrats’ $3.5 trillion “human infrastructure” spending plan would make inflation worse, leaving more American families scraping by today and saddling future generations with astronomical debt.

Soaring food prices under President Biden hurt black and brown families most, Bloomberg News reported. A Bloomberg News/Morning Consult survey shows about one in three Americans are spending more on groceries. More than 40% of black respondents reported higher costs at grocery stores in 2021. Morning Consult economist John Leer said minority communities are being hit harder because of the disproportionate impact of the pandemic.

For the federal government to spend $3.5 trillion that’s intended to help the vulnerable is digging their hole deeper rather than helping. It perpetuates a cycle of dependency rather than helping Americans stabilize and create generational wealth. Work is the top antidote to poverty and breaking the cycle of poverty. But permanent and government payments disincentivize work, both for the employee (by making unemployment more attractive) and the employer (government spending-induced inflation increases labor costs and makes automation more attractive, etc.)

Inflation means low and minimum-wage workers are poorer, and with prices rising so fast, minimum wage workers are poorer than they have been in decades, according to Business Insider. The Bureau of Labor Statistics reported minimum wage workers in 2019 were disproportionately likely to be black Americans compared to white, Asian, or Latino workers.

Economists Phil Gramm and Mike Solon note that “inflation has been particularly cruel to the working poor. Despite the economy’s growth in 1981, the 12.5% inflation rate pushed some 2.5 million people, [including] a million children into poverty.”

Inflation is essentially a tax on everyone that disproportionately hurts poor people. Lower-income families spend a greater share of their budget than wealthier families on everyday goods and services like food, housing, and health care.

Inflation is essentially a tax on everyone that disproportionately hurts poor people.

The elderly suffer as well, having spent a lifetime working only to see the value of their pensions and savings accounts evaporate during their frailest years. Gramm and Solon give the example of a one-year certificate of deposit earning roughly 0.2%, which would make a $50,000 nest egg lose almost $2,000 of purchasing power in the past seven months alone.

Before the COVID pandemic, inflation was far more manageable (it was just 1.81% from 2018 to 2019 and 1.4% from 2019 to 2020) and people actually got raises. In 2021, on paper people are getting raises (at their fastest rate since the 1980s), but they’re getting eaten up by inflation.

Average weekly earnings since January are up $15.59, The Wall Street Journal reported recently. But due to the ravages of inflation, real weekly wages actually fell by $8.99, the largest real-dollar drop in wages since the Bureau of Labor Statistics began collecting this data in 2006.

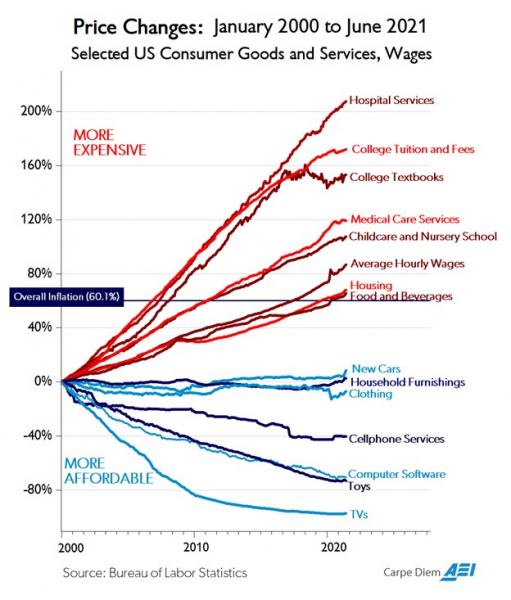

In the chart below, American Enterprise Institute economist Mark J. Perry shows the devastating impact of inflation compared to consumer goods and services. Housing, food, and beverages have now creeped above overall inflation, and hospital services continued to skyrocket in 2021, continuing a nearly 15-year trend above overall inflation.

What’s a key driver of inflation? Government spending. We’ve seen record government spending to fight the COVID-19 pandemic—already more than double New Deal spending on a per capita basis.

Last week, Senate Democrats passed a budget measure clearing the way for them to advance their hyper-partisan $3.5 trillion spending plan. This spending blueprint was released less than 24 hours prior to the vote, with lawmakers showing a shocking lack of transparency around such a massive undertaking.

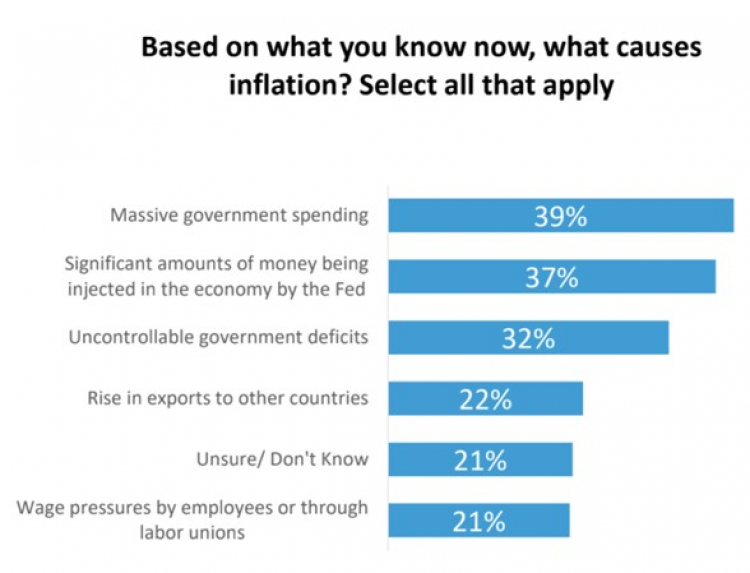

May 2021 polling by Harvard University with HarrisX found “massive government spending” was what Americans believe is the top cause for inflation. That was followed by “significant” injections of money by the Federal Reserve and, thirdly, “uncontrollable government deficits.”

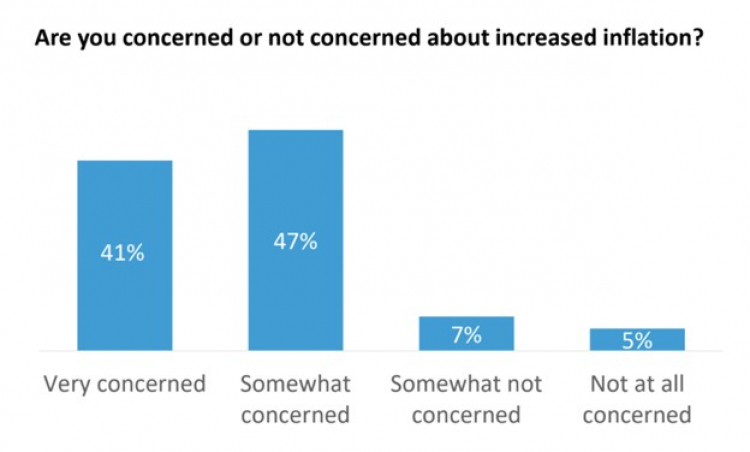

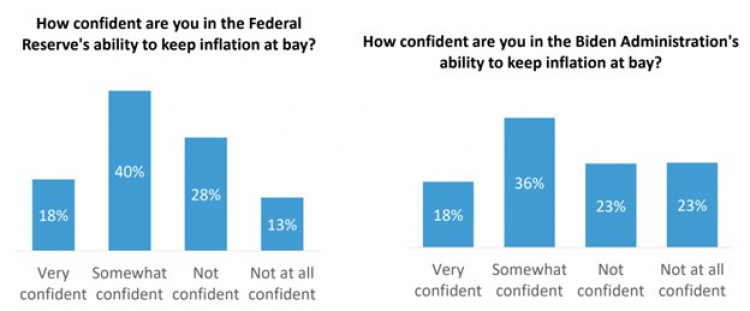

The same polling found 88% of Americans are “very” or “somewhat” concerned about rising inflation, and 48% of Americans said they were “not confident” or “not at all confident” in the Biden administration’s ability to keep inflation at bay.

Given the inflation spike, now is not the time to pass $3.5 trillion in more government spending that will sink us deep into debt and further inflate prices—hitting poor, elderly and minority families hardest.

READ MORE — Poll flashes warning signs on Democrat-only “infrastructure” bill

Carrie Sheffield is a senior policy analyst at The Independent Women’s Forum.

This article was republished with permission from RealClearPolitics.

Republicans spent 6+ Trillion dollars on the wars they started in Iraq and Afghanistan but they don’t want to spend HALF of that on Americans here at home?

Who’s “America First” again?