Federal tax lien deepens questions over Delco council president’s unpaid taxes

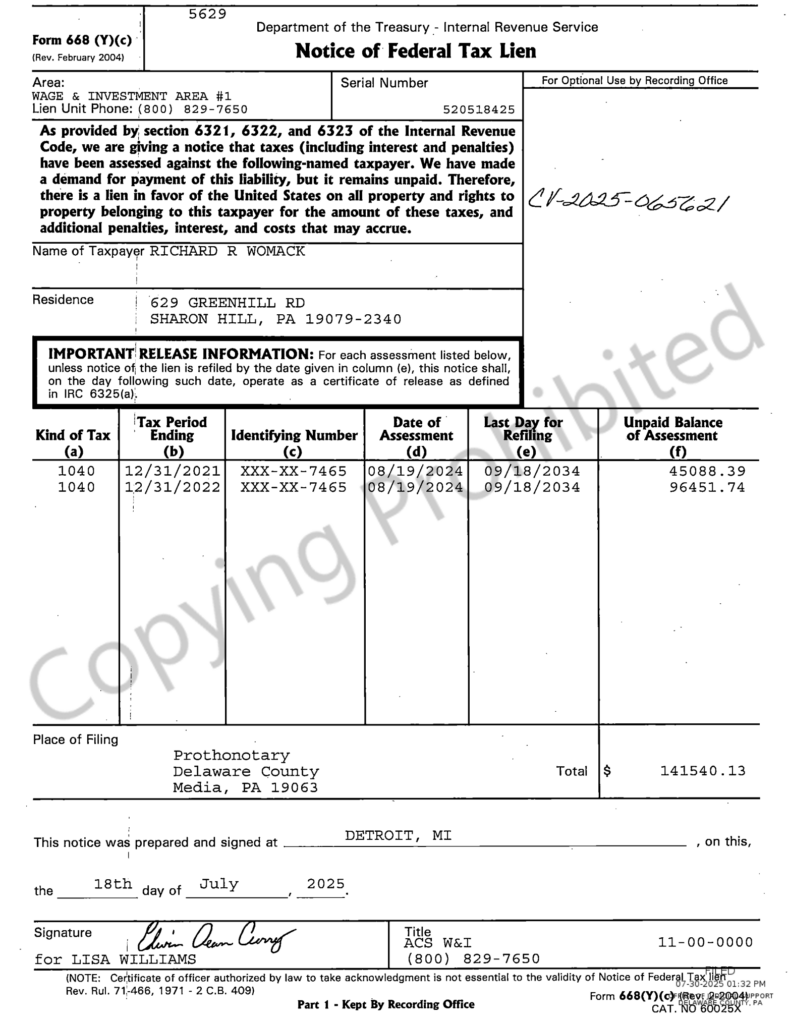

The federal government last year placed a lien on Delaware County Council President Richard Womack (D) for $141,540 in unpaid taxes, according to court documents.

This new information follows last week’s revelation Womack owed about $91,000 in back taxes on two properties, although that total was split among school districts, municipalities, as well as the county. Across all levels of government, this means that Womack owes more than $230,000 in outstanding taxes.

The county did not return a request for comment by deadline.

Womack’s tax woes have been unearthed just months after the county approved a nineteen percent tax increase for calendar year 2026. The year before that, the county approved a 24 percent increase, although Womack was the lone ‘no’ vote on council at the time. And still one year before that, the county increased taxes five percent.

Although by simple addition the tax increases total 48 percent, the net effect is more cumulative. Because each tax increase is applied to a base that was also increased the year before, a compounding effect comes into play. For a Delaware County citizen, the county portion of their real estate taxes are now more than fifty percent higher than before the three increases were approved.

According to the court document, Womack had unpaid taxes of $45,088 for calendar year 2021, and $96,451 for 2022. The lien was recorded last July, and the court document lists the same address already in the public domain identified as belonging to Womack.

When the unpaid local taxes were brought up in last week’s council meeting, Womack said his circumstances arose because he was helping to care for his ill mother.

“Situations arise and [I was] taking responsibility to help others,” Womack said. “Sometimes by helping others, sometimes I ended up falling behind … I realize I am going to pay my obligations. I have done so. I’m up-to-date on my payment plan and it will be done this year.”

Earlier this week, Womack declined to provide any additional information on the repayment plan. The other four members of council, all Democrats, also declined to answer detailed questions such as whether they knew of the delinquencies when electing Womack as council president for 2026, and whether such an issue should prevent someone from serving as the leader of council.

County council members earn an annual salary of $51,000 for what is considered a part-time position, according to an online database of salaries for public officials.

The county says about 600 residents are in repayment plans for back taxes.

Todd Shepherd is Broad + Liberty’s chief investigative reporter. Send him tips at tshepherd@broadandliberty.com, or use his encrypted email at shepherdreports@protonmail.com. @shepherdreports

I’m thinking what everyone else is thinking:

Delco Democrats are turning out as crooked as Minnesota Democrats.

So his property was liened for outstanding Federal Taxes and he is also not paying the local taxes on the property? If there is a mortgage is that current? If the property is tenant occupied can the tenant’s rent be garnished?