The False Claims Act will fight fraud and save the taxpayers money.

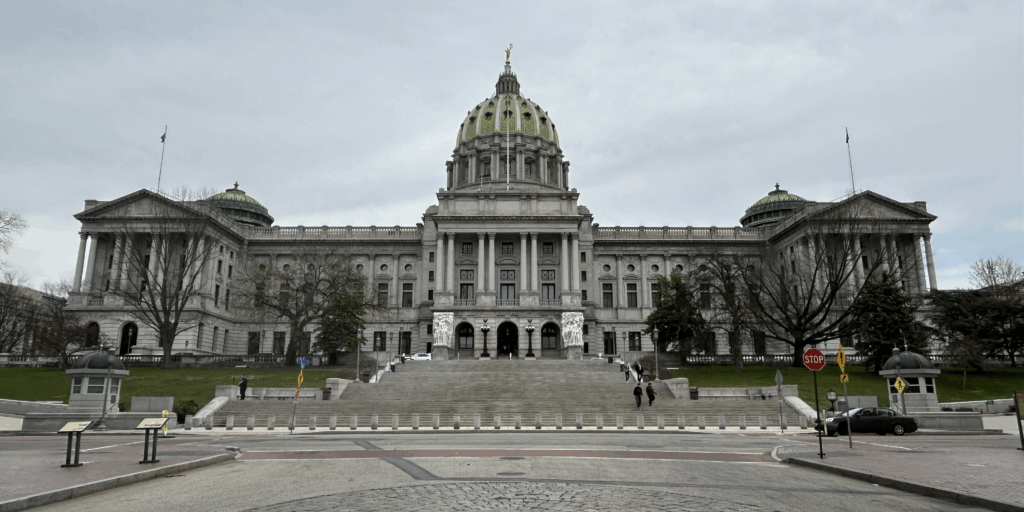

Pennsylvania’s House of Representatives recently passed HB 1697, a bill that would create a state False Claims Act (FCA) as a counterpart to the well-known federal FCA. The bill is now with the Pennsylvania Senate, which will decide whether this bill is sent to Gov. Shapiro’s desk to sign.

The Pennsylvania Senate should pass the state FCA as it will provide one of the most impactful mechanisms to combat fraud against the Commonwealth and increase funds received from federal government recoveries stemming from Medicaid fraud.

At its core, state and federal FCA laws encourage citizens to report fraud by offering a reward if money is recovered due to the information they provide. This bounty program significantly increases the number of people willing to come forward to blow the whistle on fraud and, therefore, also increases the amount of funds recovered by state and federal law enforcement.

To provide some background, the federal FCA allows for qui tam lawsuits where whistleblowers, referred to as relators, can bring a lawsuit in the federal government’s name against entities and individuals that have fraudulently obtained federal funds. FCA cases are filed under seal and typically remain sealed until law enforcement completes its investigation. The whistleblower is entitled to 15 to 30 percent of any funds recovered by the federal government as a result of the information they provide. The law also protects workers from retaliation for reporting fraudulent conduct.

The FCA is one of the federal government’s strongest tools in the fight against fraud, waste, and abuse. Between 1986 and 2023, more than $75 billion was recovered by the federal government largely through whistleblower-initiated FCA actions. In fiscal year 2023, alone, $2.3 billion of the $2.68 billion in FCA settlements and judgments (nearly 86 percent) resulted from whistleblower-initiated qui tam lawsuits. Fraud on government healthcare programs (e.g., Medicaid) accounted for $1.8 billion of the total amount recovered.

The federal government also provides financial incentives to states to enact their own FCA. Specifically, the Deficit Reduction Act of 2005 (DRA) incentivized states to enact their own FCA by increasing a state’s Medicaid fraud recovery by ten percent if the Office of Inspector General of the Department of Health and Human Services approves the state’s FCA law. In other words, when the federal government recoups Medicaid funds through an FCA action, states that have enacted their own FCA receive an additional 10 percent of the funds returned to the state.

Pennsylvania is not entitled to the additional ten percent of recouped Medicaid funds because it does not have its own FCA. As a result, the Commonwealth leaves real money on the table every year.

For example, the U.S. Attorney’s Office for the Eastern District of Pennsylvania is one of the nation’s most successful offices at pursuing FCA actions. Between 2018 and 2023, that office was responsible for $984,675,047 in FCA settlements and judgments.

While no publicly available data demonstrates the percentage of that amount attributable to Medicaid, more than 60 percent of federal FCA recoveries are attributable to healthcare fraud. As Medicaid is one of the two most extensive government healthcare programs, it is safe to assume that a significant amount of Medicaid funds is recouped annually by the Pennsylvania U.S. Attorneys’ offices.

Investing in FCA enforcement has also been profitable for the federal government. According to a study released by Taxpayers Against Fraud, between 2008 and 2012, every dollar invested by the federal government to investigate and prosecute federal health care fraud returned at least $20 back to the federal government.

Recognizing the increased enforcement capabilities and federal funds that accompany a state FCA, more than 30 states and Washington, D.C. have enacted their own FCA laws. Pennsylvania, unfortunately, has not.

If the benefits are so great, why has Pennsylvania failed to enact its own FCA? The answer is that there are misconceptions about the FCA.

The first misconception is that Pennsylvania already has multiple laws to combat fraud that do not provide a whistleblower reward, so a state FCA is unnecessary. Relatedly, the second misconception is that because the Commonwealth already has laws targeted at combating fraud, the Commonwealth will receive less by paying an award to a whistleblower. These arguments against a state FCA rely upon the false premise that financial incentives to whistleblowers do not encourage them to report fraud.

While it is true that Pennsylvania has other laws targeting fraud, none of them provide for enforcement by or a reward to the whistleblower. The qui tam feature is what makes the FCA unique and effective. Many whistleblowers would not report fraudulent conduct to law enforcement without the potential for a reward. And, because the whistleblower only receives a percentage of what the government recovers, the whistleblower does not receive an award unless the government recoups funds, so the concern that a Pennsylvania FCA will only benefit whistleblowers is unfounded.

Paying whistleblowers a bounty is not a new or novel idea; there is significant evidence that enacting an FCA significantly increases the government’s ability to identify and prosecute fraud. In 2023, the federal government recovered $2.3 billion from whistleblower-initiated FCA actions. Though the government may only receive 80 percent of the recovered funds, that is significantly more than 100 percent of $0.

Whistleblowers pursuing FCA actions also take significant risks, justifying the payment of an award. Having represented whistleblowers for over a decade, I have witnessed many of my clients suffer personal and professional backlash as a result of blowing the whistle. To expect whistleblowers to undertake these risks without the potential for a financial reward is unrealistic.

Pennsylvania is only hurting itself by failing to enact its own FCA. Hopefully, the Senate will pass HB 1697.

Ross M. Wolfe is an associate attorney at the law firm of Kang Haggerty, LLC, General Counsel for Philly GOP and the Young Republican National Federation, and has been representing whistleblowers in FCA litigation for over a decade.