Delaware County Council considering five percent real estate tax increase to cover years of new spending

Editor’s note: An update was added to the end of this article on Dec. 14.

The Delaware County Council is considering a five percent tax increase for 2024 to raise about $10 million in new revenue as the recent years of expansive spending appear to be catching up with the county council.

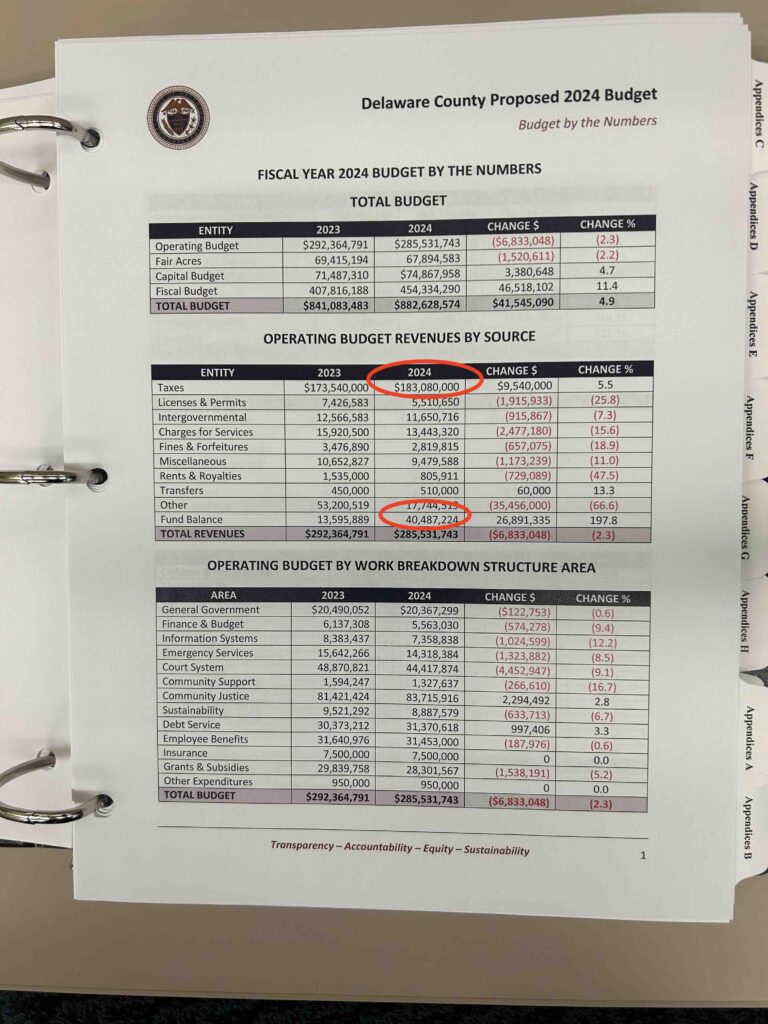

The council’s proposed budget, available for viewing in the county clerk’s office but not posted by the county online, shows the tax increase would boost revenues from $173.5 million to $183 million.

The proposed budget for next year also plans to tap a reserve fund for $40 million as well as spending nearly $10 million in non-recurring federal funds to keep the budget balanced, for a total of $50 million in spending that may be difficult to recreate in 2025.

Broad + Liberty sent an inquiry to the county to determine if council would seek an additional $50 million in property tax increases, or alternatively, enact spending cuts for a similar amount in 2025 when the deficit can no longer be camouflaged by non-recurring federal funds.

A county spokesperson did not respond with specifics to that question.

“County staff and Council Members continue to fine-tune the budget. The current proposed budget submitted by staff anticipates a real estate tax increase of 5%,” spokeswoman Adrienne Marofsky said.

“However, the 2024 budget will be reviewed by County Council at a public hearing on December 5th, and at subsequent Council meetings on the 6th and the 13th. Final decisions on tax rates and 2024 expenditures will be made as part of the ultimate budget approval by Council,” Marofsky added.

Democrats took control of the five-member council after the November elections in 2019. Among their top priorities were the creation of a health department and taking over management of the county’s prison which had been privately run for the three previous decades.

Those projects are showing strain.

For example, the county’s line item for the George W. Hill prison held steady between $46 and $47 million dollars for 2020 through 2022. The county took over the management in May 2022.

In 2023, the prison budget ballooned to $52.8 million, and the 2024 budget shows an allocation of $56.6 million — an eight percent increase from 2021, the last full calendar year the prison was privately operated.

In 2021, a year before the government would actually take over management of the prison, a consultant provided the county with three different budget scenarios, the topmost estimate being $49 million per year if the prison were nearly full. But the county has clearly shot past those predictions, as the actual $52.8 million in prison spending this year came with the daily prison population being down about twenty percent.

The county is also expecting to tap nearly $10 million in one-time funding from the federal American Rescue Plan Act which was signed into law in 2021 and was designed to help local governments recover from difficulties sustained from the 2020 Covid pandemic. ARPA funds will no longer be available to the county after 2024.

That ARPA money is broken out in two places in the budget — $2.1 million in regular operating revenue, and another $7.4 million counted as operating revenue for the county health department.

Another significant increase is the line-item budget for the county solicitor. In 2020, the last year of Republican control, the solicitor’s budget was $1.6 million. In 2021, the first year of Democrat control, that line item expanded to $2.18 million.

For the solicitor’s office in 2024, council is proposing $3.9 million, more than twice the spending for the same office in 2020.

As Broad + Liberty has noted, the county has been spending millions more on legal help from outside attorneys in the last three years.

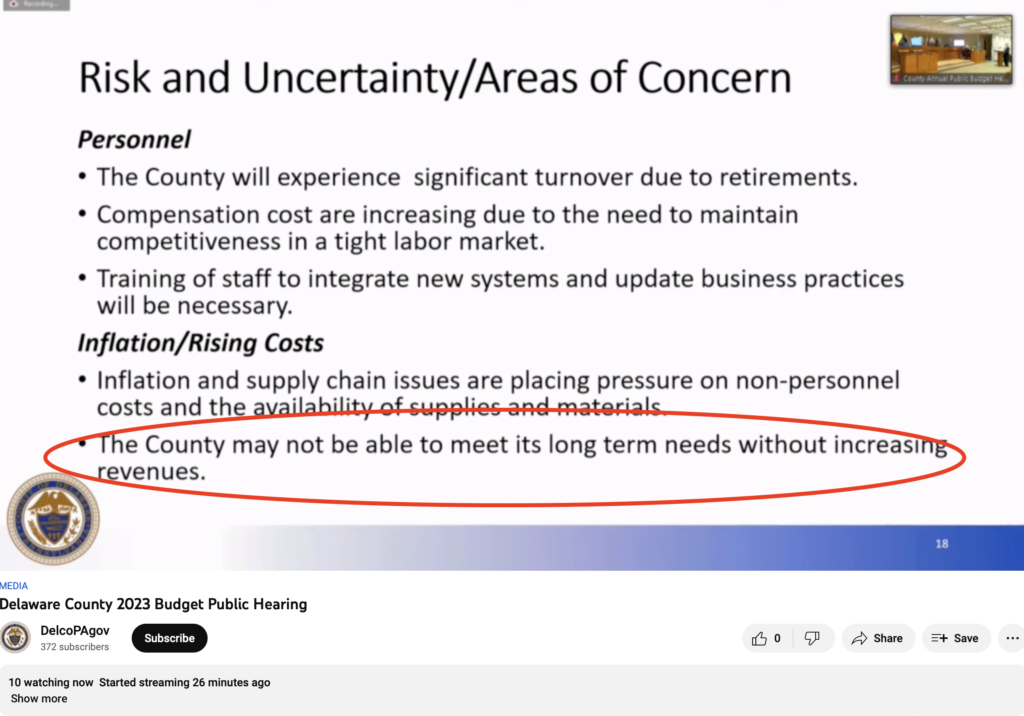

Warning signs that the county’s spending might be unsustainable have been flashing for well over a year.

In a presentation slide from 2023 dealing with personnel costs, the county noted that it “may not be able to meet its long term needs without increasing revenues.”

In the runup to this year’s election, County Councilor Christine Reuther acknowledged that “fiscal constraints” — in particular, having a variety of revenue sources — were what she saw as her biggest challenge.

“We have a system of local government funding in the state of Pennsylvania that relies almost exclusively on the property tax and then on various fees and things that the state legislature allows us to charge,” Reuther told WHYY.

WHYY reported that Reuther said “it is really hard to fund expenses when the services, wages, in an inflationary environment, keep going up.”

“But our tax base does not,” Reuther said.

To put these “fiscal constraints” in perspective, a five percent increase in real estate taxes this year covers $10 million of the county’s apparent aggregate structural deficit of $60 million. Without drastic cuts in personnel or services, council will be forced to raise property taxes by an eye-popping twenty five percent in 2025.

According to U.S. Department of Labor data released on November 14, 2023, the United States’ annual inflation rate slowed to 3.3 percent in October 2023 from 3.7 percent in August and September 2023.

TRANSPARENCY

Although “transparency” is the first word of the county’s motto, obtaining a copy of the proposed budget isn’t exactly easy at the moment. Rather than putting the document online as was previously routine, citizens now have to go to the county clerk’s office to read the document, similar to last year. It should go online later in December, however.

Broad + Liberty also had to pay $90 for a scanned copy of a paper document that clearly already existed as an electronic document.

Additionally, the document available for public inspection was changed at some point.

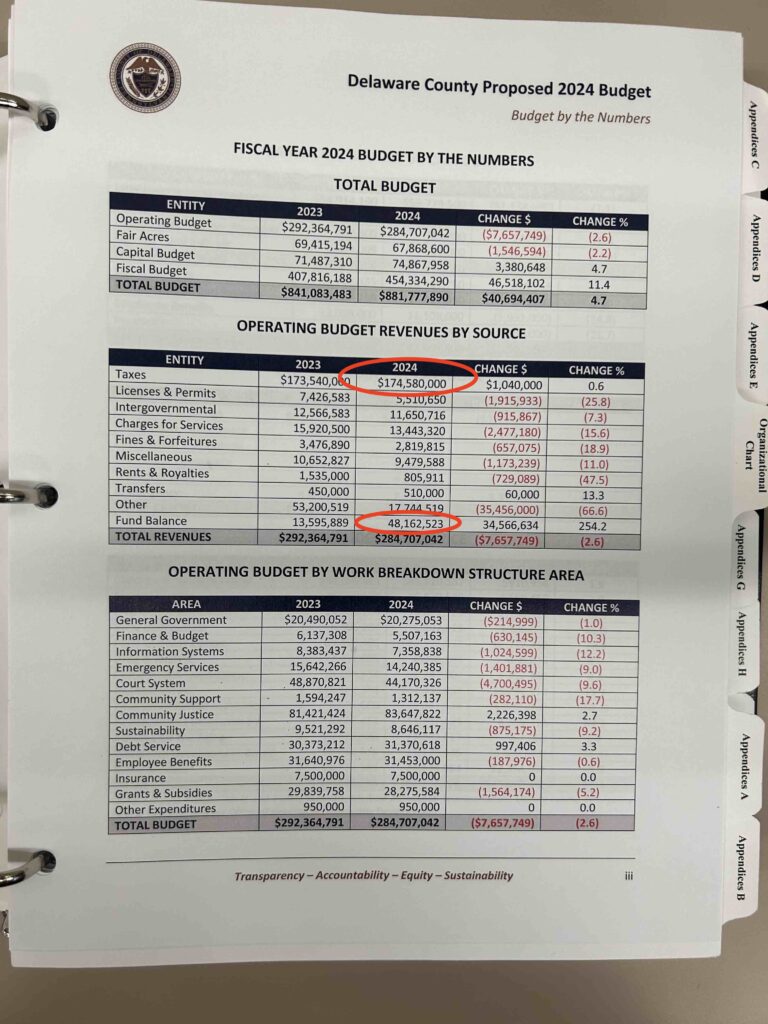

When Broad + Liberty first sent a research associate to review the document on Nov. 16, 2024 tax revenue was listed at $174.8 million, more in line with actual property tax revenues from 2020-23. And the use of the county’s reserves, called the “fund balance,” was $48 million.

When the researcher returned on Tuesday, Nov. 28, the figures had changed to those mentioned at the beginning of the story — that 2024 taxes were expected to come in at $183 million, and the fund balance spending dropped to $40 million.

Without the $10 million real estate tax this year, the county’s structural deficit in 2024 would approach $60 million.

UPDATE: On Dec. 13, the Delaware County Council adopted its proposed budget which was slightly modified from the version discussed in the original version of this story. The most significant change between the early version discussed in this story and the final budget adopted is the county says it will use $46.5 million from the fund balance, instead of an original amount of $40.5 million from the fund balance, which is essentially the reserve fund. Correspondingly, the total budget also goes up about $6 million, from $882.6 million, to $888 million.

This increase in spending from the fund balance would suggest the county faces a structural deficit in the neighborhood of $65 million, as opposed to the $60 million reported on originally.

Todd Shepherd is Broad + Liberty’s chief investigative reporter. Send him tips at tshepherd@broadandliberty.com, or use his encrypted email at shepherdreports@protonmail.com. @shepherdreports

Retired elderly people can not afford another dime increase in their property taxes especially after property is paid for. We can barely afford to eat at this point. I am not being dramatic. I have already cut all unnecessary things like cable and going out(can’t afford gas). I feel like a shut-in in my retirement years after working all my life

Those of us who are retired and are living on Social Security do not make or receive the BIG BUCKS everyone else makes. It is hard to keep up and I think/hope that a break in the taxes to help us stay in our homes would arise. Those of us that are 70 and above have definitely paid our fair share along the way. As we age, our health leaves us and we fall into Medicare and the Supplement Insurance plans which cost an arm and a leg but you MUST have at a time when we don’t have that income. So, we are left with the questions…Food? Medical Care? Housing? Which would you chose?? MUST be time for all of us to leave this world as we cannot afford to live in it.

The replies I have read are right on the money. As a retired tax payer we can not pay anymore unless they want us to be poor and it seems that’s what their goal is. It’s bad enough we at our age have to pay a large amount of school tax yet have no children in school. Delco has more rentals then owners and the renters have many children that go to school on my dime. You want more tax dollars? Then raise the taxes on rentals. They make a small fortune on subsidize housing. And the renters get a free ride. 😡

We the people need to curb these politicians spending habits. Taxes here in DelCo are out of control!! How are the retired elderly supposed to survive?? Why don’t you help us retirees?? Look at your existing budgets and cut them!!!

Or cut the hundreds of thousands to people who not only don’t do their job but actually break the law with cover

My huband and I are retired .He is 74 and I am 72. You are correct that drug cost and inflation we feel everthing that we have worked for we could be pushed out of our homes. It would break our hearts to leave my families home that they grew up in. Our school taxes in Garnet Valley and they have no break for the elderly.

That’s ridiculous for us poor people there is nothing whatsoever that has been done in my city of Chester terrible streets it’s a disgrace to even think about raising our taxes

Raising taxes in our current financial climate is proof that the elected leaders are out of touch and/or do not care for the people they are supposed to serve.

I have no respectful comment to make. You deserve none for what has been done to a beautiful place and to beautiful people who have been a part of Delaware County for over 100 years, 3 generations of hard-working families who paid their bills and made the area a better place by taking care of each other and had pride in living there. It’s now a depressing, sorry place to live. And from the sound of it you are intending on continuing the tradition. Learn how to balance the budget like the people do that live there and quit spending our money like it was yours on foolish things,

This is what happens whenever democrats are in power, taxes explode. Meanwhile all of the free loaders and leeches get raises. Instead of raping the wallets of the taxpayers, cut spending, get rid of the dead wood, it’s the government there’s no shortage of that, and live within the constraints of current tax revenues. You folks are “supposed to know what you’re doing”. Any fool can raise taxes. Try something new and exciting. Cut spending.

Let’s do away with so many county employees having take home cars. The taxpayers should not be paying for personal use of a government owned vehicle. The 911 center is a prime example of this waste.

To these Senior Citizen commentators: How many of you voted recently and who did you vote for? The time for being polite is over, and the time to vote for fiscal responsibility is your priority.

To the Republican Party: How are you going to reach these voters?

Read this transcript via the following link, and figure out a way to fill out a ballot to vote for him: https://tomklingenstein.com/my-opponents-are-cowards/

First and foremost Upper Darby as an example has been turned into west Philadelphia. Septa riders are disgusted paying to see junkies and homeless on the train going to work.. Police there make 50k and above and so nothing. Meanwhile Democrats took control and crime skyrocket. 69 St area looks like Kennsington ave with trash, needles all over people just walking out of retail stores without concern to the police.. And you want to RAISE taxes for the worst school district in years? We need to band together and raise our voices.

Any chance B&Lcould find the cost to taxpayers for frivolus election lawsuits?

A county where the Democrats registered has dwarfed the Republican numbers.

Lets not forget costs of rebuilding two blocks of razed buildings and garage that a budget conscious GOP council allowed to deteriorate and now the cost of that rebuilding will be much higher than the maintenance it would have originally cost.

They kicked the can down the road.

God just be quiet already, Matt.

Some things aren’t partisan, and this is one of them.

The Democrats are ruining every bit of the county that they’re influencing or running, and that’s not even debatable.

All they care about is themselves, and their actions have shown that and then some ever since they took over.

As you go more west from Philadelphia into Delaware County you find higher property values and higher taxes. those having higher values will feel the brunt of tax increases.

Maybe it is time for Delco to charge a county sales tax .

There are people coming from Philly and neighboring counties to shop dine go to school buy cars ,soda and anything else

While in our county our police dept must protect them,and apprehend them if they break the law,they crash up their cars ,and the police and fire rescue squads are there.,they litter and jam roadways and we pick up the tab.When we work in Philly we pay a wage tax, and an 8% sales tax and a tax on soda and purchases and meals etc.This culture of increasing taxes on our Real Estate is destructive and jeopardizes housing stability not only for the elderly who have been paying for years but to families.Lest we forget that taxpayers in William Penn District have endured underfunding of our schools for years and just had a tax hike to fund the upgrade to their athletic field . I understand costs for goods and services are rising but Seniors are on fixed incomes and some are caring for spouses and grandchildren alike .The 3% COLA on Social security is gone before they even get it if a 5 percent real estate tax is enacted.Do the math! Some seniors will end up in a hole despite the increase.After working so hard all their lives and paying taxes on homes they struggled to buy..People are not MAC machines with unlimited cash flow.They deserve better.

When is enough going to be enough. Why should retired people continue to pay school taxes when we no longer have children in the system. I have paid $195,000 in school taxes with no children in the system since 1990. And if you don’t pay this tax, your home will be taken from you, That is my retirement money that’s been siphon from me. So I worked and saved so that I can turn it over to people who work only a half a year, have many, many days off through the short months that they work, every weekend off and if it snows that’s another day off with pay. Something has to be done. Audits have to be done. Where is all the money? When you have deteriorating schools in Philadelphia and you have no money to fix them, something is very wrong.

Bob, I’d guess that there were people with no kids in school paying school tax while you had kids in school.

What is the surprise here? The voters wanted the Democrats and they got them. Democrats spend money and raise taxes. They are very open about it.

Thank you Bill – You are completely correct. Screw these socialist pigs.

You get what you vote for…