Terry Tracy: Delco using $60 million in non-recurring funds to balance FY 2023 Proposed Budget — taxpayer beware

In early October, I warned in these pages that the new all-Democratic Delaware County Council was on a budget-busting spending run that would necessarily result in tax increases for Delco residents.

With the publishing of the county’s proposed budget for fiscal year 2023 (FY23) last week, more evidence of the inevitable has begun to appear.

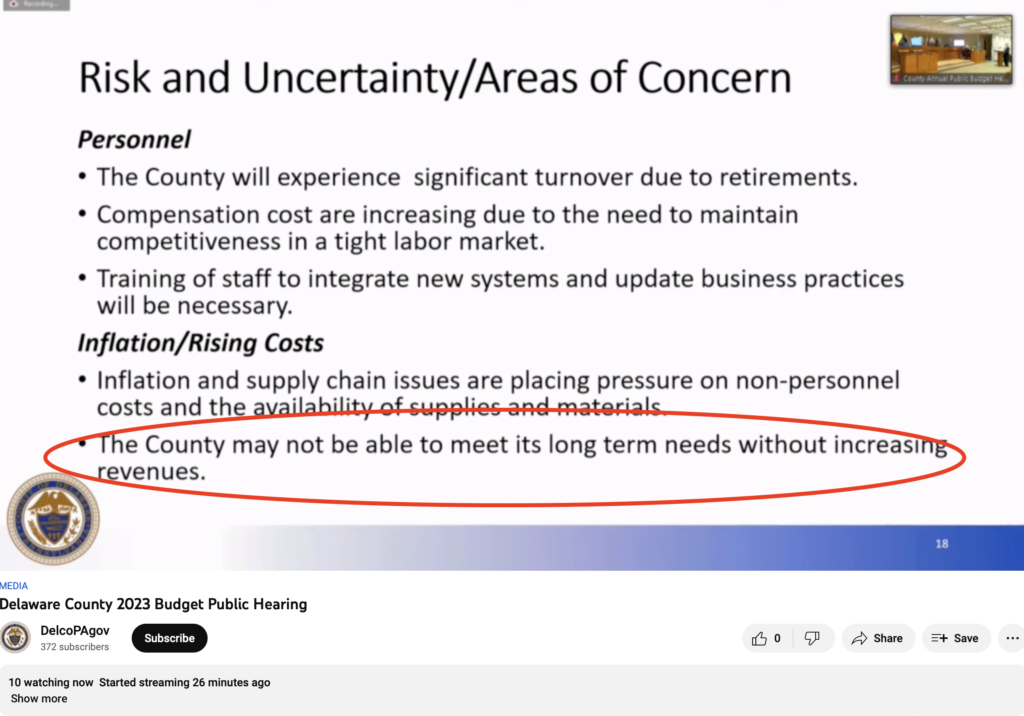

Roughly twenty minutes into the council meeting that was the first read-through of the 2023 proposed budget, the county presented a slide with the following remark: “The County may not be able to meet its long term needs without increasing revenues.”

While I welcome the honesty, it won’t surprise anyone that I believe this admission likely drastically undersells the true nature of the problem.

Much of the county budget is fixed. The part that is under the county’s control, which is more flexible and funded primarily by local tax revenue, is the “operating budget.”

Total expenditures in the last GOP-controlled operating budget in 2019 was $255 million. In FY23, that figure climbs up to $292 million. However, real estate tax revenue — which is more than 80 percent of all the taxes the county collects — remained consistent at $172 to $174 million each year.

This is important because the county will be spending funds from the American Rescue Plan Act, or ARPA. ARPA funds allocated in FY23 are designated as “lost revenue” related to Covid-19, meaning the funds are intended to replace revenues that may have fallen off because of reduced economic activity at the height of the pandemic.

However, given the county’s tax structure, it did not lose revenue in any meaningful way from the pandemic. When revenues fell, expenses also fell accordingly while the primary revenue base — property taxes — held constant.

It becomes more and more clear that the county is using non-recurring monies like the ARPA funds to cover new spending, a practice it condemns as a “historical practice of filling the gap” in its own summation of the budget.

In order to balance the FY23 $292 million operating budget, the county allocates $37 million in ARPA funds and $13 million from the fund balance. (The fund balance is accumulated savings from prior years’ budgets typically referred to as “rainy day funds” reserved to pay for unforeseen events such as natural disasters or litigation.)

Interestingly, the line item “community health” — which is where funds earmarked for the county health department are historically allocated — has been zeroed out. The county has moved its newly created Delaware County Health Department (DCHD) out of the operating budget, thereby making it a stand-alone operation in the budget.

When one accounts for the DCHD in order to get an apples-to-apples comparison on operating expenditures year over year, the county has increased spending by $18 million, from $292 million to $310 million.

That’s a six percent increase from last year and a 22 percent increase from the last GOP budget.

This greatly undermines the county’s claim in its press release that it cut the budget by four percent.

That reduction actually came from a reduction in federal and state pass-through grants, mostly programs associated with Covid-19 relief efforts, such as rent subsidies.

In addition to the $37 million of ARPA allocation to cover operating deficits, another $9M in ARPA funds is allocated to the new DHCD stand-alone budget.

Add it all up and you have $46.5 million in ARPA funds subsidizing core county operations. $46.5 million in ARPA combined with the $13 million allocation from the fund balance, means the county is using approximately $60 million in non-recurring revenues to pay for recurring obligations.

For that operating loss to be covered in future years starting with a real estate tax base of $173 million, the county would have to raise taxes by 35 percent to cover the deficit.

If I had to make a prediction, Delaware County residents should brace themselves for very substantial tax increases.

To further illustrate the point — and the risk to the taxpayer — the county could increase all other local revenue sources such as licenses, fees, etc., by 25 percent and would still have to raise real estate taxes by 30 percent to cover the deficit.

While we won’t have exact figures until the county releases its audit results in 2023, the impact on the fund balance is concerning for three reasons:

1) It is trending to levels, as a percent to obligations, that could threaten the county’s bond rating, making it more expensive for taxpayers to borrow.

2) The county will likely face fairly significant legal judgments in the near term for the juvenile detention center scandal and the uptick in prison deaths.

And, 3) the ability to cover new spending and operating deficits with non-recurring funds will soon be a thing of the past. Indeed, should the fund balance continue to be spent at this rate, it is likely to be exhausted in the next few years.

So, our analysis concludes the county has a substantial revenue shortfall, but its 491-page budget document lacks any substantial explanation as to why or how it is planning to subsidize its $60 million operating deficit in future budgets without ARPA funds, which, by statute, must be spent by 2024. If I had to make a prediction, Delaware County residents should brace themselves for very substantial tax increases.

Perhaps this is why, as Broad + Liberty reported last week, Delaware County was the last of the suburban counties to post its budget online. While county law requires the executive director to submit a proposed budget at least 60 days prior to the start of the new fiscal year; the county did not make it available to the public online until Dec. 8, 2022, and only after Broad + Liberty inquired as to whether such a practice met the county administration’s definition of transparency.

The FY23 Proposed Budget is being considered for adoption at tonight’s 6 p.m. county council meeting and the public will be able to voice their concerns prior to Council voting on it. You can learn more about how to participate in the process here.

Terry Tracy is a Delaware County resident, and President & CEO of Broad + Liberty.

Unfortunately, I do not think anyone cares until the tax bill comes due.

They should hire another DEI Officer to make sure the tax bill is being raised equitably.

Having been in government finance all my working career and as a township supervisor, I would say that most governments want to be everything to everybody (and at the same time get reelected), accounts are routinely manipulated to bypass providing a true statement of financial position (who even cares about Generally Accepted Accounting Principles?). As long as the citizens are willing to allow elected officials and their bureaucrats to spread pixie dust on the books, things will not change. My final shot is against citizens who routinely want government to provide for them, at minimal cost and without raising taxes. I’m reminded of the old rhyme: “Don’t tax you, don’t tax me, tax the man behind the tree.”

“A people that elect corrupt politicians, imposters, thieves, and traitors are not victims…but accomplices.” George Orwell