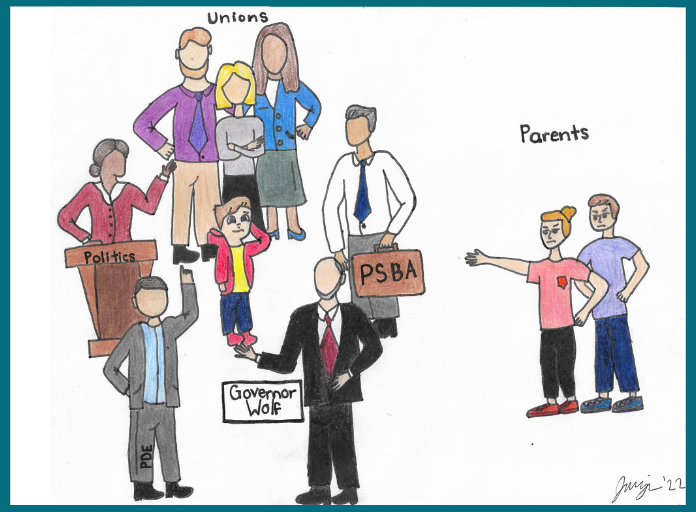

Taxpayer-funded lobbyists block K-12 education reform

Pennsylvania parents who support school choice initiatives are financially supporting lobbying organizations that do not.

That’s because their tax dollars provide school districts with millions of dollars that are paid into membership organizations with a vested interest in opposing education alternatives.

At a time when both houses of the Legislature are pushing for policy changes that would provide parents with options outside of conventional public schools, those same parents should know they are operating at a financial disadvantage in the policy arena.

At least $24.1 million in tax dollars were spent on membership organizations that participated in lobbying efforts from 2017 to 2020 while 26 local governments and agencies spent $18 million in tax dollars to hire contract lobbyists since 2007, according to two new reports from the Commonwealth Foundation, a free market think tank based in Harrisburg.

The figures low ball the amount of money taxpayers are on the hook for, as only 40% of the 1,518 government entities that received open records requests responded. Public school officials figure prominently in this equation. Out of the 571 school entities that received open records requests, just 105 responded—a response rate of 18%.

The Commonwealth Foundation combined Right-to-Know records with the Pennsylvania State Department’s online database to pull in records dating back to 2007. Despite the low response rate, the figures remain very telling for parents, students, and lawmakers with a stake in education reform.

The 105 school districts that responded reported more than $10 million paid to membership organizations. The Pennsylvania School Boards Association rings the bell as a $9 million organization with nine registered lobbyists funded by $7.2 million in taxpayer-funded dues. The Right-to-Know requests identified about $4.3 million in payments from individual school districts to the School Boards Association, which amounts to half of all reported payments from school districts to various member organizations.

So, how has this money been invested?

The School Boards Association has a long history of lobbying at taxpayer expense against public charter school funding and tax credit programs that support private school scholarships. This would help to explain why some of the pending education reform legislation faces an uphill fight despite enjoying broad public support. Recent surveys show a substantial majority of Pennsylvania voters support a wide range of school choice initiatives.

The most comprehensive education reform package in circulation is House Bill 1, which incorporates both public and private school options. The bill would open new avenues for charter schools, expand existing tax credit scholarship programs and create Education Opportunity Accounts where the state would deposit roughly $6,000 per student for parents to spend on education services.

The School Boards Association has a long history of lobbying at taxpayer expense against public charter school funding and tax credit programs that support private school scholarships.

“Pennsylvania is fortunate to have fantastic schools that come in different forms,” Rep. Andrew Lewis, a Dauphin County Republican, and the lead sponsor of the bill said in a press release. “If passed into law, House Bill 1 would give families access to scholarships that give them more options.”

As an added feature, Lewis’s bill also creates incentives and protections for learning pods that took root during the Covid-19 pandemic where groups of parents joined forces to educate their children at home.

While there hasn’t been any movement on HB 1 so far this year, modified versions of its individual proposals have been folded into other legislation. On the Senate side, for example, the education committee recently approved legislation from Sen. Mike Regan, a Republican representing parts of Cumberland and York Counties, that would automatically raise the caps for the Educational Improvement Tax Credit and the Opportunity Scholarship Tax Credit programs.

Sen. Ryan Aument, a Republican representing parts of Lancaster County, is the lead sponsor of a bill that would create a “universal Education Savings Account” for parents and students to use for the duration of the Covid-19 pandemic. This would be a temporary program that draws federal funds from the American Rescue Plan Act. Eligible parents would have the ability to use funds to defray the costs of educational alternatives to their public schools.

Meanwhile Sen. Judy Ward, a Republican representing Blair, Fulton, and parts of Cumberland, Franklin, and Huntingdon counties, has introduced a school choice bill that would benefit families residing in the state’s “lowest-achieving school districts,” according to a legislative memo. Ward’s proposed “Lifeline Scholarships” would permit parents to tap into state funds to “offset costs associated with choosing an alternative academic setting that meets their child’s individual needs,” the memo explains. The scholarships would be similar to existing 529 plans that enable parents to save for college expenses.

Since Pennsylvania will assume a heightened profile during the 2022 midterm elections with two statewide races, education reform will certainly be a topic of conversation. Even as they encounter opposition from well-funded special interests, the proponents of school choice bills will likely score points with parents and students. But is there a way to level the playing field with superintendents, school boards, administrators, and other public-school offices who utilize tax dollars to block reforms that taxpayers favor?

There are two bills (HB 1607 and SB 802) that would prohibit taxpayer-funded lobbying contracts. Parents who are poised to benefit from school choice proposals might want to ask the gubernatorial candidates if they are willing to sign off on either or both bills.

The well-endowed School Board Association was quick to pounce on Regan’s bill with a letter to the Senate Education Committee expressing its opposition to the expansion of tax credit scholarships while unwittingly making the case for bills that help to end taxpayer-funded lobbying.

A complete list of the expenditures where taxpayer money has been used to pay lobbyists is available here.

Kevin Mooney (@KevinMooneyDC) is an investigative reporter for the Commonwealth Foundation. He writes for several national publications.