Wally Nunn: Who can afford to live here anymore?

People talk endlessly about the cost of buying a home — interest rates, bidding wars, low inventory. But that’s not what really determines affordability. For most families, the question is much simpler:

“Can we afford this house month after month?”

That’s where affordability lives or dies. And when you run the numbers in Delaware County — especially in working-class towns like Upper Darby — the answer is increasingly: No, we cannot.

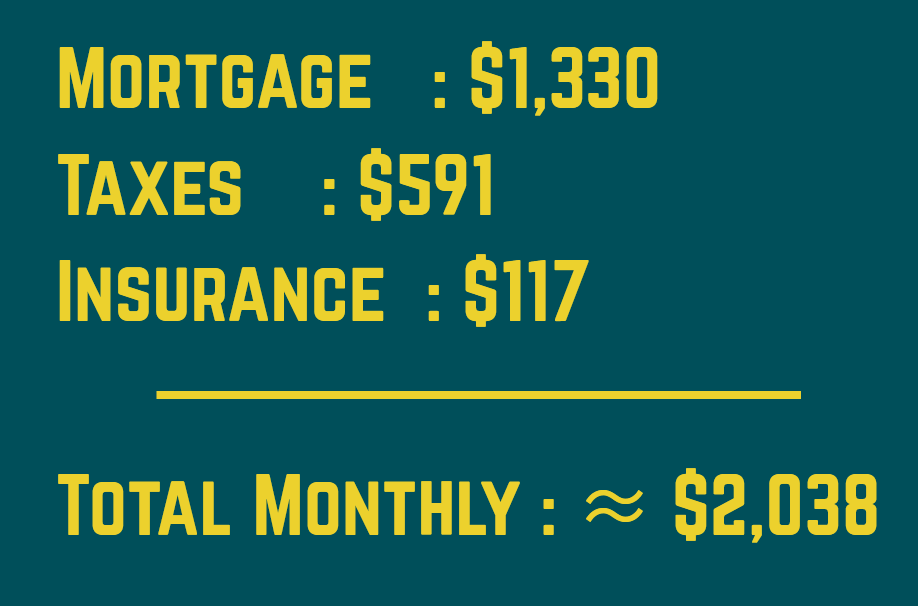

Take a typical $250,000 Upper Darby home. With 20 percent down and today’s still-elevated mortgage rates, monthly principal and interest come to about $1,330.

That’s not great, but it is manageable. Until the tax bill arrives.

Upper Darby homeowners pay roughly $7,095 a year in real estate taxes — about $591 per month. Add roughly $117 for homeowners insurance and the picture becomes ugly:

For a township with a median income of about $69,000, that means the average family spends nearly 35 percent of their income just to stay in a modest home. For comparison, financial planners warn families not to exceed 28 percent.

Upper Darby households don’t just exceed that figure — they blow past it before the lights are even turned on.

It’s easy to point at Upper Darby and say, “Well, taxes are high there.” But that misses the real story. Upper Darby isn’t the problem — it’s the example.

The same math plays out across the state, in Norristown, Coatesville, Pottstown, Bristol Township, Reading, York, and parts of Pittsburgh. Any place where you combine modest home values with high real estate taxes, families face housing burdens of 32 to 40 percent of their household income.

This is not just mismanagement by one township or school district, though there is plenty of that. This is a structural flaw in how Pennsylvania funds local government and — especially — how it funds public education.

Property taxes were never designed to carry this load. They do not adjust when wages stagnate. They punish seniors. They hit working families hardest. And they make it nearly impossible for first-time buyers to get a foothold in communities that were once affordable.

This is what a systemic failure looks like.

Young Families Can’t Get Started — and Seniors Can’t Stay

A young family looking at a home in Upper Darby may be able to handle a $1,330 mortgage. What they can’t handle is the $591 monthly tax bill — a bill that goes up whether their income does or not.

A retired couple on fixed income doesn’t pay lower taxes just because they retired. Their tax burden stays; their income does not.

Seniors get trapped. Young people get priced out. Working families live on the edge. And communities get hollowed out from underneath.

Politicians often talk about “sky-high home prices.” But this crisis is not just about sale prices. Even when prices stabilize, the monthly payment won’t — not as long as real estate taxes rise faster than incomes.

Most people are being priced out by the monthly bill, not the listing price. And in Pennsylvania, a significant part of that bill is driven by the payment that buyers cannot avoid and cannot negotiate: Property taxes.

If we want families to stay in the communities they love, and if we want first-time buyers to build their lives here, we must finally confront a question Harrisburg has ducked for decades:

Should Pennsylvania shift some or all school funding away from local property taxes and toward a statewide income or sales tax — a system that more closely aligns with the ability to pay?

Other states have done it. We can too. And the families struggling to afford a modest home in Upper Darby — and in nearly every county across this Commonwealth — deserve nothing less.

Wally Nunn is the former Chairman of Delaware County Council.

Add to this the cost of a Catholic/Christian school education; diligent parents won’t subject their children to the Upper Darby School District.

Wally,

The problems of affordability aren’t because of the way Pennsylvania real estate taxes are structured. Property taxes in Pennsylvania trace their origins to the colonial period under British rule, where local taxes on land and property were common for funding local needs. After independence, the practice continued and was embedded in state law. For school districts, the reliance on local property taxes became prominent in the 19th century as public education expanded. Pennsylvania’s public school system was established by law in 1834, and local property taxes quickly became the primary funding source for schools, supplemented minimally by state aid. This local-heavy model has persisted, with school districts historically and currently deriving a significant portion (often over 50-60% in many cases) of their revenue from property taxes. Affordability is a problem by intentional design of the oligarchs and the Fed; the US has defaulted twice already: FIRST TIME) FDR said: “We’re going to make dollars worth less gold.” The government raised the official price of gold from about $20 per ounce to $35. This made each dollar buy less gold than before. People who had lent money to the government (or had contracts promising payment in “gold dollars”) got paid back in the new, weaker dollars instead of the stronger gold-backed ones they expected. It was like the government saying, “We’ll pay you, but the money isn’t as valuable as we promised.” Some people called this a sneaky way of partly defaulting because it reduced what lenders really got back. The Supreme Court said it was okay because the country was in an emergency.

SECOND TIME) So… other countries could still trade their dollars for U.S. gold at the fixed $35 price. But the U.S. was printing lots more dollars (for wars and programs), and people worried there wasn’t enough gold to go around. In 1971, Nixon said: “No more swapping dollars for gold.” This ended the last big link between dollars and gold. It was indeed a default (the U.S. still paid back bonds in dollars, but it broke a long-standing promise to foreign governments about their gold) on our international promise.

By changing the rules on what money was backed by, it made those payments worth less than promised in gold terms. It was rewriting the deal after borrowing the money. Most “experts” say the U.S. has a perfect record on actually paying its debts on time, but they are liars.

Guess what? The United States is about to default again in a big way. Real estate taxes aren’t the darn problem, Wally. Our spending, and lack of good moral grounding as a society are the actual problems. Every single time a nation turns away from God they get lost.

Have no fear! Pray, and God will help you.

how about with the promise of State dollars going to local municipalities for school funding with the extra money made on all these casino and gambling establishments that were promised? we’re talking billions of dollars here. people. this is b*******

Robert, you nailed it. And the next scam cooking seems to be school choice vouchers… what a joke. All they will do is increase the cost of parochial and private schools, dramatically and suddenly. School choice vouchers will simply inject government tax money into the system. It does not immediately create new unproven schools to appear out of thin air; the (unintended?) consequence or turning on the spicket of money will simply be create increased demand and then all the existing private schools’ tuitions will skyrocket to even higher prices.

First, I want to point out that Pennsylvania’s income tax does not recognize income levels. It is a flat tax and not bracketed like the federal income tax. That is due to the Pennsylvania Constitution. I also want to point out that property tax is not the only expense that is more or less permanent with home ownership, namely, insurance, trash collection, sewer, electric, heating costs, and house maintenance. Iffy controllable expenses would be telephone and tv and/or internet. As inflation raises general costs in the economy, it affects the non-tax costs of owning a home. Keep in mind that both county and local governments levy property taxes and eliminating property taxes means that these two government layers will need to be added to any income tax rate. I remember a saying an old minister of mine said many years ago: “be careful what you pray for, you might get it.”

What is the fix? Poorly planned overdevelopment in the suburban counties has already occurred. Failure to link infrastructure improvements to housing development is at the root of the property tax issue. In addition, as much as this may be an unpopular point, but most people want what taxes fund but then complain when they have to pay for it. As far as taxes raised for seniors being “unfair,” I have to ask, are they? A senior I know bought her home in Marple Township for 125K – it is now paid off and is valued at over 500K. So the question is, should she be paying higher property taxes?